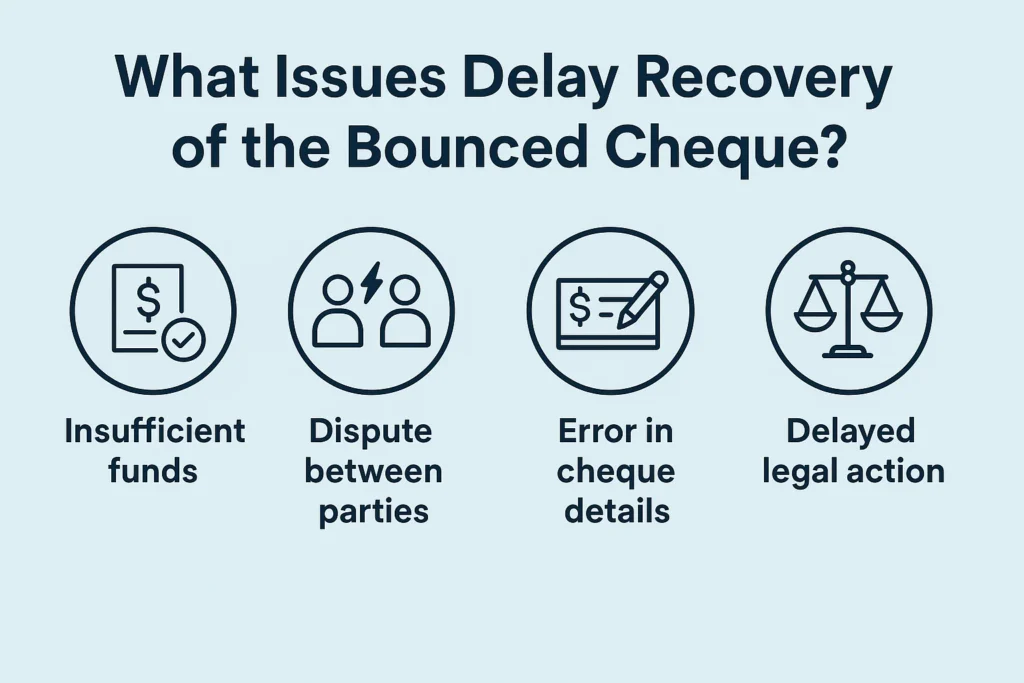

What Issues Delay Recovery of the Bounced Cheque?

A bounced cheque is more than just a financial inconvenience—it can become a stressful legal battle. In Pakistan, thousands of such cases pile up in courts every year, leaving payees waiting months or even years for Recovery of the Bounced Cheque. But why exactly does the process take so long? In this guide, we will uncover the hidden issues that delay cheque recovery, explore legal requirements, and share strategies to speed things up. Most importantly, we’ll show how professional support from experts like thefirstcallsol can help you avoid common mistakes and reclaim your money efficiently. Why Cheque Bounce Cases Take Time A dishonored cheque should ideally result in quick compensation, but the ground reality is different. Several layers of legal, procedural, and practical challenges slow down the process. Let’s break them down one by one. Key Issues That Cause Delays in Bounced Cheque Recovery Court Backlogs and Systemic Delays Pakistan’s courts already struggle with a heavy backlog of cases. Adding cheque dishonor complaints to the pile means that hearings often get adjourned repeatedly. Even after filing, securing an early hearing date is a challenge. Example: A business owner in Karachi filed a case in 2022, but due to repeated adjournments, his matter was still pending after 18 months. Missing or Weak Documentation Proper paperwork is the backbone of cheque recovery. Many complainants fail to present: The original cheque Bank return memo showing dishonor reason Contract, invoice, or proof of transaction Copies of communication with the issuer Without these, the court spends months verifying facts, giving the defendant more room to stall. Deliberate Delaying Tactics by the Issuer Defendants often use clever strategies to drag cases, such as: Filing fake counterclaims to confuse the matter Changing addresses to avoid summons Requesting medical exemptions or absence excuses Applying for stays in higher courts Such tactics may not ultimately succeed, but they waste valuable time. Confusion Over Jurisdiction Another common issue is choosing the wrong forum. Should the case be filed under civil recovery or criminal law (Section 489-F of PPC)? Many people misfile, only to restart the process later. This confusion alone can waste months. Ignorance of Legal Timelines Under the law, the payee must issue a legal notice within 30 days of receiving the dishonor memo. Missing this deadline can dismiss the case before it even begins. Unfortunately, many individuals delay action, hoping the issuer will pay voluntarily—only to lose their legal right later. False Promises of Settlement Sometimes the issuer keeps asking for “a few more weeks” to arrange payment. Believing these promises, the payee avoids legal action. By the time negotiations fail, the notice deadline or filing period may already have lapsed. Lack of Expert Guidance Many people try to pursue cheque recovery without hiring skilled lawyers or consultants. A small drafting mistake, wrong jurisdiction, or missed deadline can extend the case unnecessarily. This is why many turn to professional service providers like thefirstcallsol, who specialize in corporate debt recovery. Legal Remedies Available in Pakistan Cheque dishonor is not only a civil wrong but also a criminal offense. Here’s a breakdown of available remedies: Criminal Remedy: Section 489-F of the PPC can send the issuer to jail for issuing a cheque dishonestly. Civil Remedy: Victims can file a recovery suit under the Negotiable Instruments Act, 1881, to claim the amount and damages. Both options are available, but choosing the right one—and sometimes combining them—makes all the difference in reducing delays. How to Avoid Delays in Cheque Recovery While you cannot control the speed of the judicial system, you can take practical steps to avoid unnecessary delays: Prepare Evidence in Advance Keep the original cheque, dishonor memo, invoices, and contracts well-organized. Strong evidence minimizes courtroom disputes. Act Quickly Send the legal notice within 30 days and file the case without waiting too long. The faster you act, the fewer chances the issuer gets to manipulate timelines. Select the Right Forum Seek advice on whether to proceed with civil recovery, criminal action, or both. Filing in the wrong forum is one of the most common reasons for delay. Engage Professionals Legal and corporate experts like thefirstcallsol can prepare airtight notices, file in the correct courts, and counter delaying tactics effectively. Their experience often shortens case duration significantly. Stay Firm Against False Negotiations If the issuer is only buying time, avoid wasting months in back-and-forth discussions. File your case promptly to secure your position. How thefirstcallsol Helps in Faster Recovery Professional services bring a structured and aggressive approach to cheque recovery. With thefirstcallsol you get: Drafting of legally sound notices that force issuers to respond Filing cases in the right courts without procedural errors Representation to counter delaying tactics Negotiation skills to settle where possible, without wasting time Compliance with strict legal timelines In short, their expertise ensures that you don’t fall victim to the common traps that delay recovery. Conclusion Cheque bounce disputes in Pakistan are not only stressful but also time-consuming. Procedural loopholes, court backlogs, weak documentation, and deliberate delaying tactics are the main culprits behind recovery delays. However, by acting promptly, preparing strong evidence, and seeking expert guidance from professionals like thefirstcallsol, victims can secure faster recovery and reduce stress. Remember, the longer you wait, the weaker your position becomes. Taking proactive legal steps is always the best strategy. FAQs

What Issues Delay Recovery of the Bounced Cheque? Read More »